Whitepapers

Managing that Important Cash Flow in Retirement

How Will Taxes Impact My Retirement Income?

Alternative Investments in This Turbulent Market

Managing Your Monthly Money Leaks This Year

How To Navigate Global Geopolitical Events

Great Member - Guest Golf and Asset Allocation

Read, Set, Goal!

Ten Very Unique New Year Financial Resolutions

The 5 Elements of Financial Wellness

Focusing on Your Finances

Put Yourself in Front of the Savings Game

How to Prioritize What's Important in Your Budget

Private Capital

Spending Policy

Philosophy & Process

Governance

The Tax Advantages of Charitable Gift Annuities

Doing Well by Doing Good

Protecting Your Future with a Living Will

Can a Living Trust Replace Your Will?

Creating and Preserving Family Wealth

Aging Parents and Money

Business Use of Life Insurance: Corporate-Owned Life Insurance

Assigning Your Life Insurance Policy

Is Your Current Life Insurance Coverage On Par?

The Power of Legal Protection

Understanding Bond Listings and Transactions

Types of Bonds By Issuer

Bonding With Your Portolio

Balancing Your Investment Choices with Asset Allocation

Asset Allocation - Projecting a Glide Path

Celebrating Women's History Month with Hetty

Benefits of Owning a 2nd Home in Today's Market

Your Financial Portrait

Get SMART: Tips for Effective Goal Setting

Donor-Advised Funds

Charitable Deduction

Advanced Philanthropy

2024 Outlook: Finally "Normal"

Estate Planning Issues Concerning Unmarried Couples

Updating Your Will Can Contribute to a Relaxing Retirement

Divorce & Estate Planning

What Key Estate Planning Tools Should I Know About

Customizing Trusts

Navigating Long Term Care

Changing Jobs? Know Your 401(k) Options

529 Plan

The World of Alternative Investments

Understanding Interest Rates and Your Financial Situation

Stocks and Bonds Before and After Taxes

A Path To Setting And Reaching Your 2023 Goals

Emergency Savings or Retirement Goals?

Pros and Cons of Charitable Giving Strategies

Year-End Considerations

Important Steps in Preserving Your Estate

7 Retirement Considerations

Assessing Your Retirement Resources

Inflation Impacts Your Insurance Coverage Too

Life Insurance: How Much Is Enough?

S Corporations vs. LLCs

Understanding the Estate Planning Process

Insurance Protection for Life's Key Stages

Paying The Bills: Potential Sources of Retirement Income

Retirement Income Investing: Beyond Annuities

How Much Annual Income Can Your Retirement Portfolio Provide?

A Retirement Roadmap For Women

Generating Tax-free Income

What Is Asset Allocation and How Does It Work

A Path to Setting and Reaching Your 2022 Goals

Checking Your Fiscal Fitness

The Spending Plan: Setting and Prioritizing Your Budget Goals

Starting Your New Year Off on the Right Foot

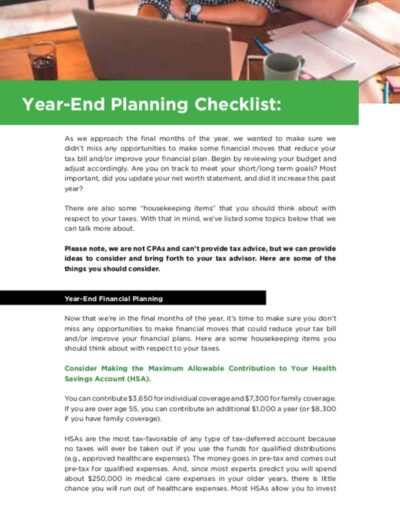

Your Guide to Year-End Financial Planning 2021

Bequests to Charity in a Will Must be Measurable

Helping Your Heirs While Helping Others

Donating to Charity

Why Capitalism Helps Giving to Charities

Estate Planning — What Is It? What Can It Do?

Preparing for Medicare Enrollment - EG piece

Medicare Planning - EG piece

Preserve Your Retirement Savings with Long-Term Care Insurance (LTCi)

What to Do When Your Term Life Insurance Is Expiring

Life Insurance: How Much Is Enough?

Elder Law and Managing Risks

Special Needs Trust – Capital First

Domestic Asset Protection Trusts (DAPT) – Capital First

Preserve Protected Assets with a Spendthrift Trust

The Benefits of Revocable and Irrevocable Trusts

The Reality of Who Needs a Prenuptial Agreement

Asset Protection Planning with LLCs and Corporations

The Importance of Estate Planning

Lifecycle Planning for a Solid Risk Management Foundation

Generating Income in a Low-Yield Environment

Strategies for Tax Efficient Investing

The Periodic Table of Asset Allocation and Rotation

The Importance of Asset Allocation and Rotation in Stocks and Bonds

Ready, Set, GOAL!

The Ultimate Retirement Goal Checklist

How to Write a Personal Financial Statement

9 Key Reasons Net Worth is Important

Establishing A Budget

10 Reasons For Using Cash Analysis in Your Budgeting

Resources for You

Webinars

Expand your financial literacy with valuable webinars developed by our experts. Learn about asset management, financial planning, and more.

Videos

Watch our videos to help get you started on your journey toward financial freedom. Learn actionable tips for responsible investing and insurance.

Calculators

Use our calculators to make informed decisions about your investments, retirement savings, automotive loans, mortgage, and personal finances.