Market Update for the Month Ending February 28, 2023

Posted March 7th, 2023

Down Month for Markets

February was a challenging month for investors as early gains were wiped out by a late-month sell-off. All three major U.S. equity indices ended in the red. The S&P 500 and Dow Jones Industrial Average lost 2.44 percent and 3.94 percent, respectively. The Nasdaq Composite held up best, with the technology-heavy index down 1.01 percent. Rising bond yields pressured equity valuations and performance.

Per Bloomberg Intelligence, as of March 1, 2023, with 98 percent of companies having reported actual earnings, the blended earnings decline for the S&P 500 during the fourth quarter of 2022 was 2.5 percent. This result is slightly better than the 3.3 percent decline expected at the start of earnings season, but marks the first quarter with a year-over-year drop in earnings growth since the third quarter of 2020.

All three major indices finished above their respective 200-day moving averages for the second consecutive month. All three indices remained above their respective trend lines, which is an encouraging sign that investor confidence in U.S. equities didn’t shift.

International equities had a similar month to the U.S. The MSCI EAFE Index and MSCI Emerging Markets Index fell 2.09 percent and 6.48 percent, respectively. Technical factors were mixed for international markets; the MSCI EAFE Index finished above trend while the MSCI Emerging Markets Index fell below its 200-day moving average.

Fixed income markets also suffered losses as rising rates negatively impacted the prices of existing bonds. The 10-year U.S. Treasury yield jumped from 3.39 percent to 3.92 percent. The notable increase in yields pressured fixed income investors as the Bloomberg Aggregate Bond Index lost 2.59 percent. High-yield fixed income held up slightly better. The Bloomberg U.S. Corporate High Yield Index lost 1.29 percent. High-yield credit spreads tightened modestly.

Inflation Fears Spark Rate Rise

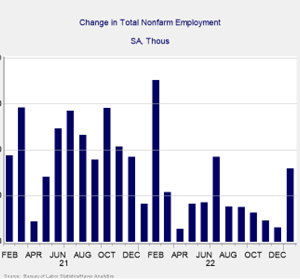

Market turbulence was primarily due to rising investor concerns about inflation and the Federal Reserve (Fed). While inflationary pressure remains below the highs we saw in 2022, January’s higher-than-expected price growth is a reminder that there is still work to be done. The Fed hiked the federal funds rate 25 basis points at its February meeting. But January’s employment report showed a surge in hiring to start the year, as shown in Figure 1.

Figure 1. Change in Total Nonfarm Employment, February 2021–January 2023

Source: Bureau of Labor Statistics/Haver Analytics

The unemployment rate also fell in February. The strong job market helped support a return to consumer spending, with personal spending and retail sales coming in above economist estimates in January.

Service sector confidence rebounded into expansionary territory in January. This follows a one-month drop into contractionary territory for the index and signals healthy levels of business confidence that helped support a rebound in business investment to start the year. Better-than-expected economic fundamentals are a positive sign for investors. The odds of a recession in the short term appear to have dropped and the most likely path forward is continued economic growth.

Risks Worth Monitoring

Despite largely encouraging economic fundamentals, several risks should be monitored. In the U.S., concerns about the debt ceiling and a government default are rising as we get closer to a potential default in the summer or early fall. Given the uncertainty this face-off creates, it will be a widely monitored risk factor until a deal is struck.

Housing sales also continued to fall to start the year; high prices, low supply, and high mortgage rates dampened potential home buyer demand. Given the housing sector’s importance for the overall economy, it will be an important area to monitor in the months and years ahead as a potential long-term risk.

China remains a source for uncertainty, as the country’s reopening efforts have yet to be fully absorbed by the global economy. There is also potential for additional conflict from the ongoing Russian invasion of Ukraine, and it’s important to remember that unknown risks could negatively impact investors.

Outlook Still Positive

We finished the month with a combination of good and bad news, which explains the market moves we saw in February. Many risks are anticipated to improve in the months ahead. While prices increased more than expected in January, year-over-year inflation remains well below the highs we saw last year, and additional improvements are expected as the Fed works to constrain rising prices.

We can also expect to see some form of resolution on the debt ceiling stand-off, using history as a guide. Short-term market volatility is likely, but the economy and markets ended February in a relatively good place overall. Given the potential for further short-term uncertainty, a well-diversified portfolio that matches investor timelines and goals remains the best path forward for most. As always, you should reach out to your financial advisor to discuss your current plan if you have concerns.

All information is according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

DBA Name is located at Full Registered Branch Address and can be reached at Firm Phone Number. [Insert disclosure from approved letterhead.] If you need assistance with your disclosure, please call Compliance at x9603 or email Advertising Review at advertising@commonwealth.com.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, senior investment research analyst, at Commonwealth Financial Network®.

© 2023 Commonwealth Financial Network®